What is Collateral in Share Market

Collateral is the amount to be deposited in the broker’s account before buying any share. To simply understand, collateral is the security amount that needs to be paid to the broker at the time of share buy.

How Much Collateral is Needed?

There is no exact amount that how much collateral needed, but at least 25% of the total amount should be loaded beforehand. The multiplication factor (either x2, or x4) depends upon the broker and your relation. This means if you are a new investor and recently opened an account with a broker then they may ask you to load 100% amount beforehand. But if you have a good relationship with the broker then you can load only 25% amount. The rest of the 75% money can be paid the next day.

What are Cash Collateral and Non-cash Collateral?

Cash collateral is the exact amount that you loaded into your TMS account. Non-cash collateral is the amount that is added by the broker.

Let’s understand this with one example – If you have loaded 10,000 collaterals to your TMS account then cash collateral is Rs. 10000. If your broker adds just numbers 90000 (not actual cash) in your TMS just to let you buy the shares worth of 1,00,000 then that 90,000 is non-cash collateral.

If you buy a share worth 1,00,000, then you have to pay that 90,000 the next day.

What is EOD Pay in TMS?

EOD stands for End of the Day. It is the system of paying the amount after buying a share. If you buy shares in continuous sessions then you have to pay the amount by 12 PM the next day. There are actually two payment methods inside TMS. Collateral payment and EOD payment. If you have enough collateral amount loaded beforehand then you can simply pay through collateral. But if you do not have enough collateral then you can pay via EOD methods. But you also can pay via collateral by loading the rest of the amount in collateral itself.

These days you can also make broker payments through eSewa and Connect IPS easily. Direct deposit in the broker’s account can also be done.

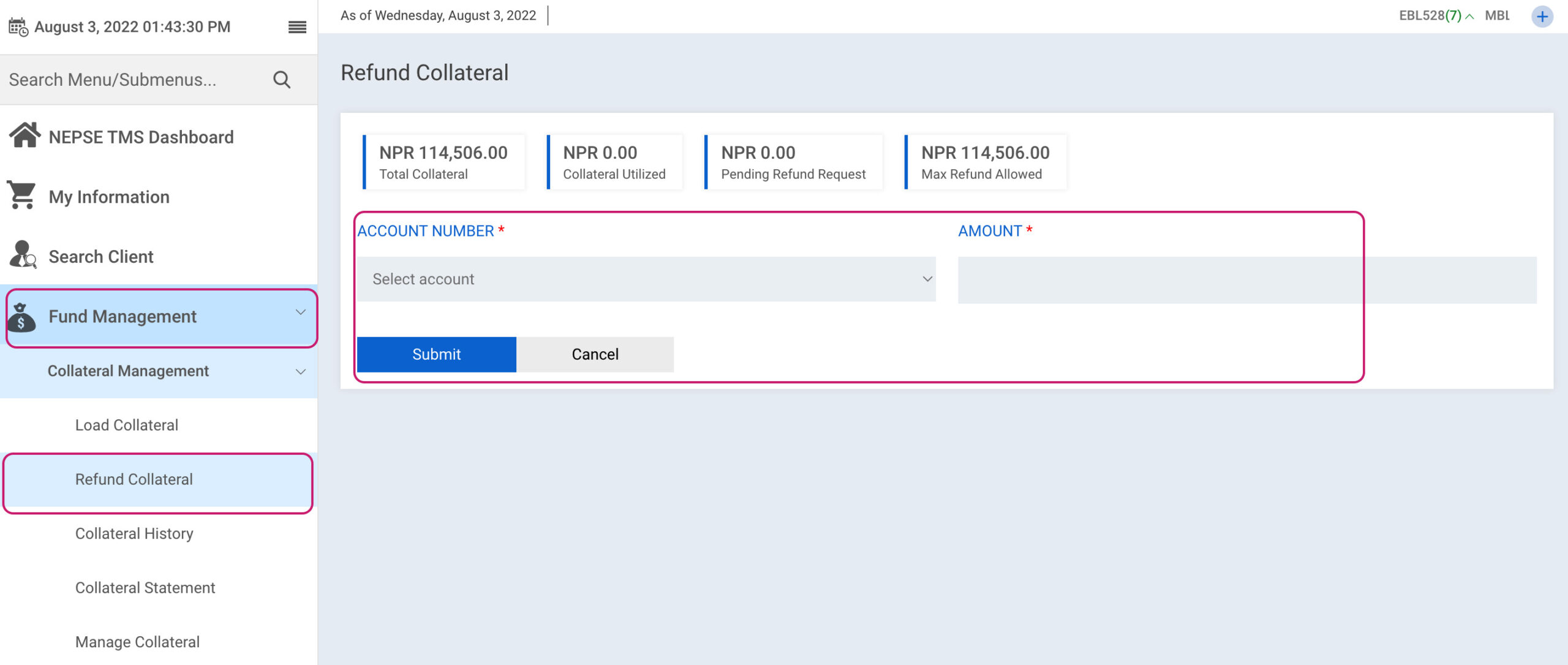

How to Refund the Collateral?

Collateral amount can also be refunded. If you are not buying shares anytime soon and you have enough collateral loaded into your TMS account you can refund your amount to your bank. To refund the collateral amount you need to –

- Lon In your TMS Account

- Go to Fund Management

- Refund Collateral

After requesting a refund, you need to make a call to your broker to let them know that you have requested a refund. After a few business days, your amount will be deposited into your respective bank account. You need to be in regular contact if they delay.

What is Collateral Multiplication Factor?

The collateral multiplication factor is the factor that allows an individual to buy the share amount. Brokers set the multiplication factor to x2, x4 according to their customer.

- If multiplication factor is 1 – you can buy the share of the exact amount as your collateral amount

- If multiplication factor is x2 – you can buy the share 2 times your collateral amount

- If multiplication factor is x4 – you can buy the share 4 times your collateral amount

For example – If you multiplication factor is x2 and you buy the share worth 1,00,000, then you need to load the collateral Rs. 50,000 beforehand. You can pay the rest of the 50,000 on the next day through collateral payment, EOD Payment, Wallets, CIPS or direct bank transfer.

To check the collateral multiplication factor

- Lon in your TMS account

- Collateral

- Manage Collateral

Other Posts